As the calendar year draws to a close, many organisations will also be thinking ahead to the end of the financial year. Doing this in SAP Business One is straightforward, though as with any task that you only carry out once a year, it’s easy to forget how to do things the right way.

To save you time crawling through the guidance, we asked the SAP Business One team here at Thinc to write up a quick guide to closing the year. Read on for a technical walkthrough, some expert tips and a checklist of all the necessary steps.

The period end closing utility in SAP Business One

The period end closing utility is run in SAP Business One at the end of financial year to close the profit and loss (P&L) for the previous year and roll the net income into the next periods retained earnings.

The utility calculates the balance for each P&L account for the selected period and presents the balances in the form of a list with check boxes. Only the balances you select will be rolled into retained earnings.

You can run this utility several times, but it will only show balances that haven’t previously been rolled into the retaining earnings.

SAP Business One has produced detailed guidance on using this facility – but our guidance below will give you the fundamentals to quickly close the year’s accounts.

Where to start when closing the year

To find the period end closing utility in SAP Business one, choose the following menu option

Modules > Administration > Utilities > Period End Closing

Prerequisites for closing the year

Before you get started, here are a few things you’ll need in place:

- Make sure you have a period end closing GL (general ledger) account and a retained earnings account defined.

- The period end closing account is a clearing account where all the P&L transactions are moved to on the last day of the financial year.

- The period end closing account must be a balance sheet account and it typically resides in the same drawer as the retained earnings account.

- The retain earnings account should be an account in the Capital and Reserves drawer. This is the account where the balance of the period end closing account is moved from on the first day of the new financial year.

Important considerations before you run the utility

Once year process has been run, it is irreversible. So, before you hit the button, consider the following steps:

- Back up the database before proceeding.

- Execute the utility in a test database to familiarise yourself with the process and the results.

At Thinc we’re here to help our clients wherever they may be unsure. If you raise a ticket to Thinc’s support desk, we will backup your live system and create a new test database for you to run the year in process in first.

Running the period end closing in SAP Business One

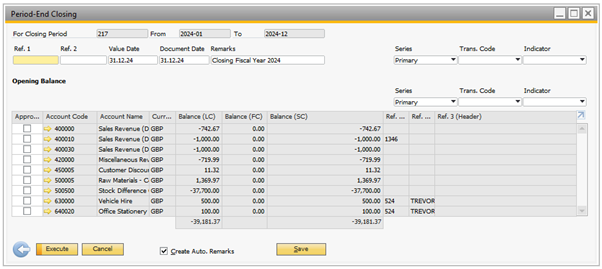

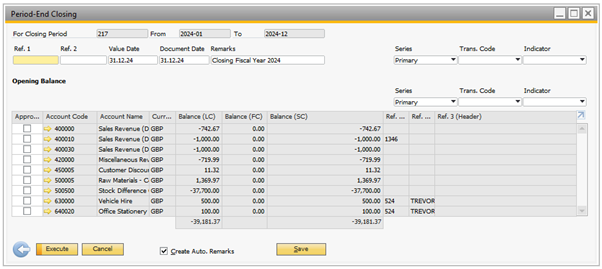

Ready to get started? Here’s what happens next. Within the period end closing window, check the following:

- Set the value date and document date to be the last day of the financial year.

- The Ref1, Ref2 and Remarks fields will appear on the closing journals entries and therefore visible on the general ledger. It is worth entering a meaningful note into these.

- Select the accounts and click Execute.

And that’s it – you’ve closed the year!

Expert tips for closing the year in SAP Business One

To help you wrap the year up smoothly, Thinc’s SAP Business One has the following additional tips for you.

- Are you performing a stock take? Applications like Produmex Scan can make stock counting in the warehouse a lot quicker and help to reduce counting errors.

- To post the year end journal, SAP requires the posting period to be open. Rather than using the Unlocked status on the posting period, use the Closing Period status instead. This will then allow you to setup authorisations against users to stop people posting into periods with this status. This in turn gives you greater control on the journals being made and will stop posting errors happening while you are performing the year end.

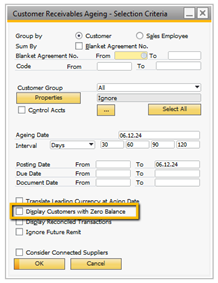

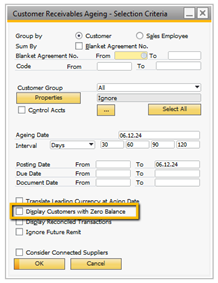

- When running the ageing reports to reconcile either the Trade Debtors or Trade Creditor accounts, make sure the Display Customers with Zero Balance checkbox is set to yes. The reason for this is because although the accounts my be zero now, they might have had a balance when back dating the report.

- Use the stock audit report to reconcile the stock to the balance sheet.

- Make sure the date is set to Posting Date

- Leave the From date field blank as we are trying to reconcile to a balance sheet account.

- First run the Summarise by Accounts first to make sure you are trying to reconcile against all the relevant GL accounts.

5. If you can’t see a period within the period end closing selection criteria, this means that posting period is still locked.

Checklist for closing the year in SAP Business One

To help you work through the steps involved in closing the year in SAP Business One, here’s a checklist of the key tasks to complete.

- Check all Sales Orders and Purchase orders for the last financial year have been added.

- Check all draft documents that need to be created for the last financial year have been added.

- Check all pending approval documents for the last financial year have been processed.

- Check all pending recurring postings for the last financial year have been processed.

- Check all pending reverse transactions for the last financial year have been processed.

- Post all AP and AR documents for the last financial year:

- Invoices

- Credit Notes

- Deliveries

- Returns

- Perform a stock count.

- Check all monthly accruals for the last financial year have been posted.

- Check all payroll journals for the last financial year have been posted.

- Check all fixed asset depreciation has been performed.

- Change the status of all the posting periods for last financial year to be Closing Period.

- Perform reconciliations:

- Trade Debtors

- Trade Creditors

- Stock Accounts

- GRNI (Goods Received Not Invoiced)

- Bank Statements

- Create new periods for the new fiscal year.

- Change the Fiscal Year in the Fixed Assets.

- Run the Period End Closing Utility.

- Change the period status to Locked for all last financial year’s periods.

Need help with SAP Business One?

We hope you find these tips helpful, and that you and your teams get a long and restful break.

If you’re already a Thinc client and want to get in touch with us over the festive period, our support teams will be on hand to help.

- 24 December 2024 (Christmas Eve): 8.30am-4pm

- 25 December 2024 (Christmas Day): Closed

- 26 December 2024 (Boxing Day): Closed

- 27-31 December 2024: Normal hours (8.30am-5pm)

- 1 January 2025 (New Years Day): Closed

- 2 January 2025 onwards: Normal hours (8.30am-5pm)

If you don’t work with Thinc but are looking for a partner who can help you deploy or manage SAP Business One, we’re here to discuss your needs at a time that suits you.

On behalf of the whole team at Thinc, we wish you happy holidays and all the best for the new year.